Getting the attention of clinicians and managers who are very busy doing their day job is not easy. The NHS is under immense pressure not only to continue to deliver improved care but also to change how it is delivering care to meet rising and changing demand with an essentially fixed amount of money and resources - all at the same time. Patience and persistence with good humour are thus vital characteristics to have.

Identifying the best point of entry is tricky too. Sometimes it is best to connect at individual Commissioning Group or Trust level, sometimes going through national or regional arms-length bodies is better depends on a number of factors like what your product can do.

What is critical is that you have a solution that will solve a real problem and that you have a compelling case for its adoption.

Why can dealing with the NHS sometimes seem difficult and confusing?

I have been surprised the number of people, who are trying to enter the NHS for the first time, who labour under the misunderstanding that there is one person or NHS body that, once convinced, will decide that the whole of the NHS will buy their product.

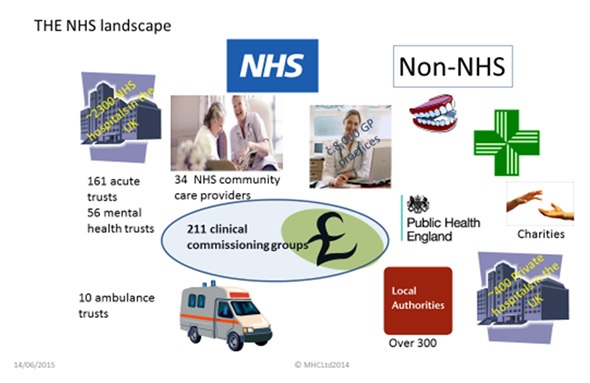

In England at least, there are hundreds of individual Provider Trusts and Commissioning Groups and plenty of more potential customers besides all of whom decide for themselves what to buy.

Layered on top of this is still a range of organisations inhabit the wider NHS landscape- NICE, Supply Chain, NHS England, AHSNs, NIHR, etc.

It is a complex environment and knowing who can really help at each stage of the adoption ‘journey’ (I hate that word!) and who can’t is confusing and time-consuming.

Even though the recent Innovation Health and Wealth paper has recognised that the NHS can be a driver of growth of the sector, I believe, there still remains a suspicion of the motives of Industry and a resistance to engage with them.

In my mind a major reason for this is that at the ‘coal-face’ of care delivery, I see few if any people whose day job is to engage with industry and drive innovation into routine use.

This is getting worse as the pressures of increasing demands to deliver current care increase. A novel way to incentivise adoption of innovation is sorely needed.

I think too that the presentation of the NHS in the media is always one of a changing, even failing organisation - only bad news sells as one nurse told me.

But whatever the political/media climate, it is important to remember that delivery of healthcare carries on and the vast majority of people delivering and managing care want to do the best for the patients - which is what the vast majority of people involved in the Med-Tech Industry want too - it is why they and I got into it.

How important is it to be NHS-ready and what are the most important factors to consider?

Being ‘NHS-READY’ is an essential precursor to commercial success. It means that you will be better able to present your product or service in terms that are meaningful to your potential customer. This has to happen before any formal procurement process begins.

I think the key factors to get right when getting ready to enter the NHS market are:

- Know who your paying customers really are and what is driving them

- Know your product’s true value and how you are going to ensure it is realised

- Know all stakeholders than can influence successful adoption of your product

- Have a sound financial case and a win: win business model

- Ensure you have the capability and capacity to research these things thoroughly and early

How important is innovation in today’s market?

For me, innovation really means change for the better. I believe there is a significant element of ‘change fatigue’ in the NHS and the word innovation has been over-used, misused and is falling foul of this fatigue.

In common with healthcare systems across the ‘developed’ world, the NHS is slowly but surely undergoing seismic change. For me, it is inevitable - change is necessary in all of business life and healthcare is no different.

Compared to when the NHS was founded in 1947, today, we are facing totally different healthcare challenges that cannot be completely and adequately met by the current way healthcare is delivered.

For me this is not a privatisation issue, it is about making an organisation fit for a changed purpose and to respond to changing demand. Successful companies do this all the time, yet up until now there seems to be an inertia for ‘the NHS’ to adapt and change. The old adage “if you always do what you’ve always done, you’ll always get what you’ve always got” cannot be more apt right now. Innovation is therefore a essential tool to effect change.

Today's NHS commissioners and providers are increasingly looking for innovative solutions to their current challenges of increased and changing demand for healthcare services whilst simultaneously controlling costs and continuing to deliver care - a monumentally difficult task but one that must be and is being undertaken.

The necessary innovations can come from both within and without the NHS. There is a large programme of fostering and developing innovative ideas from NHS staff and this is to be celebrated. But with a word of caution - such ‘in to out’ innovation is in the main, incremental and aimed at doing what is currently done better - continuous improvement by any other name and something that any responsible organisation of any size should do.

‘Out-to-in’ innovation, that is from industry is as, if not more, important because it is more likely to be a radical or even disruptive change, enabling care to be delivered differently and I think this makes a lot of people nervous

In the cash-limited NHS environment both types of innovation now demand a detailed and well-constructed case for adopting new services and medical products and at the local level since this is where the decisions are now increasingly made.

In what ways does value differ from cost and what tips would you give for demonstrating added value?

Porter defines Value as Quality/Cost. This means you can add value by decreasing cost and keeping outcome the same. Today, I see lower costs with improved quality (however that is measured) as the norm for providers and commissioners alike.

For healthcare, Porter substitutes patient outcome for quality and this is fine at the macro-health economic scale that Commissioners are interested in. But, in the vast majority of cases, Commissioners don’t buy Med-Tech products. Providers buy them to include in care pathways and healthcare services and the challenge is to define value in terms that are relevant to them.

I think, Clayton Christensen’s concept of the value proposition is a powerful one here. Christensen describes the value proposition in terms of the ‘job to be done’. The ‘job to be done’ is one which a customer wants to get done more effectively than the way they currently do, or one that they can’t get done at all.

I have seen value proposition presented as something to do with economics and financial return. It isn’t. It’s about solving a real problem, it’s about getting a job done.

The value of a device is no longer solely in the product itself. While clinical efficacy is a must, in today’s climate additional value will come from the ability to help customers to also solve non-clinical problems such as using resources (including staff) more efficiently, reducing length of hospital stays, delivering care closer to home, and reducing future hospitalisation. There may be more than one ‘job to be done’- clinical and operational.

When should market access planning happen?

The short answer is the sooner the better. I have seen market access described as being about “packaging data in the right way, for the right customer at the right time” and I think this is a good description. However, this assumes you have developed the right product for the ‘job to be done’ by your target customer and you have generated the right data or at least know what is needed.

In my ideal world, the three highly interdependent activities of product development, regulatory compliance (where required) and marketing strategy should run concurrently. Two examples from my experience illustrate this.

I was involved in a start-up Med Tech company that has intellectual property rights in a particular medical field. Before I got involved, the target customer had been identified as the Consultant in secondary care and the ‘job to be done’ was to be better than the gold diagnostic standard So, the product was developed to fit into this environment and ‘need’.

As things progressed, we realised that whilst the gold standard test was tiring for patients and in some cases needed a couple of goes to get results, it worked well enough and was well established, as gold standard tests are. It was going to be a long slog to replace it.

We started looking for other markets, and discovered one that would be interested in what we said our technology could do better than the products they currently used. However, the device that was already designed for use in NHS clinics was too big (and costly) for the other market sector. If we had done proper research into the larger market before we translated the IP into a product, we would have identified the right (best) customer, got the product development right first time and have planned to get the right data available at the right time.

Secondly, I worked with another client whose initial plan was to develop a new diagnostic test for a particular condition. To do so would have meant that their device would have been a higher classification under European Regulations and would require more complex data to support its claim.

Review of their data gathered through product development and of what the device actually did suggested that it could be initially positioned as an aid to current diagnostic procedures to improve the speed and accuracy of diagnosis. This, along with the data they already had from R&D trials enabled them to classify the device as a class I device, avoid the clinical trial and go to market quicker.

An early and insightful understanding of who your best customer is and their real ‘job to be done’ will better inform product design and your regulatory strategy.

In my real world, clients have moved along way down the product development and are often in the process of securing any regulatory approvals and think they are ready to go to market. More often than not, the product is right for the right job but the data (or evidence) they will need has not been thoroughly researched.

I would suggest then that market access planning should start before any regulatory trials are undertaken so you can develop an integrated and efficient ‘evidence gathering’ plan.

What factors need to be considered when deciding who to market to?

Firstly and simply, find out who will pay for your product or service. There is some confusion about the role of Commissioners in buying Med-Tech.

Decision-making is becoming an increasingly complex and lengthy process, involving multiple stakeholders and requiring much information, all before any procurement can start.

The impact on all aspects of an operation and service-delivery will be considered. Only then will the provider or commissioner go out to procure your product (or service) and often as a pilot evaluation in the first instance.

Comprehensive and thorough stakeholder mapping and analysis is really important. There are people, stakeholders, who although will not have the ultimate decision to procure a new product, will be influential in that decision and in the success of adopting it into routine use.

The action or reaction of any one of these stakeholders can be the difference between success and failure of the pilot and subsequent adoption into routine use

How can you make sure that your evidence is sufficient to support your claimed clinical benefits and what further evidence is necessary?

Healthcare is still essentially clinically-led. Simply offering cost-saving, often based on national-scale data, cuts little ice with NHS decision-makers.

Today more than ever before, good quality and accepted evidence is demanded for any type of new care or intervention. This has always comprised scientific evidence, a sound basis of accepted basic research that underpins a technology or treatment and clinical evidence that your product does what it claims to do. NICE often observe that the available evidence is insufficient to support or doesn’t match the claimed benefits.

Relevant and high quality evidence of clinical benefit from clinical studies is therefore vital but I think there is a need for evidence beyond clinical performance: Local decisions to buy new products and services will increasingly include evidence of benefit to the system and process of healthcare delivery such as productivity, patient experience as well as the obvious need for financial benefit- evidence of utility.

Interestingly, I recently attended a seminar where the established concept of evidence generated by the gold standard of a randomised controlled trial was being questioned as both valid, especially for tele-health products, and indeed as a potential barrier to adopting innovation. I think this view may also extend to the lower risk Med-Tech products and a carefully thought-out strategy to gather evidence, planned in collaboration with NHS clinicians and managers, is vital.

It is important to recognise that, almost by definition whilst an innovative product may have good scientific or clinical evidence, utility evidence will be scarce. A well-constructed, evidence-based case for adoption, will help to convince forward thinking commissioners and/or providers to pilot test your product to realise its utility benefits.

What value does a clinical champion provide and also how important is it to leverage patient knowledge?

As I noted earlier, healthcare is still essentially clinically-led, so a clinical champion is vital (for a clinical product of course). Without one, or ideally a few, it will be extremely difficult to get started. Where care is multi-disciplinary, for example cancer care, I would extend this concept to gaining the support of the team but you need an introduction to them.

I am wholly in favour of getting patients involved as early as possible, to give advice on product design, to provide input into study protocols and care pathway design - I know of some interesting activity in this area in my region of England and for their experience to be part of the metrics in utility studies. Fully using this dimension in a case for adopting innovation is young and I don’t think is well established yet but I am convinced it is set to grow in importance.

How do you think the market is going to change and what advice would you give on how to prepare?

This is a huge question and one that is difficult to answer without provoking hot political debate. As I said earlier, I don’t see market access and adoption of innovation as being in the debate about privatisation and the principles of care for all, free at the point of delivery.

What care is delivered will change with scientific progress and demand. We hear of personalised or stratified medicine- tailoring treatment based on the individual’s genetic make-up. Diagnostics will be developed to identify which people will respond best to which treatment. We have to find cures or ways of managing dementia and other conditions associated with increasing life expectancy.

How new and current care is best delivered will also change, because it has to meet the expectations and needs of the people who must have it. There is a move to integrated care, the linking of health and social care. Where possible self-care and care outside hospital will increase.

As it always has been, healthcare and Med-Tech is exciting and full of opportunity. Be lively and alert to these opportunities, be flexible in how you take them and I would remember that whatever the future of the NHS turns out to be, caring for people’s health will always be a corner stone of our society- there will always be a need for innovative ways to do it.

Where can readers find more information?

I would love to hear what readers have to say on this topic and continue the discussion. Connect with me on LinkedIn or sign up for my new on line digest of innovation and adoption in healthcare by going to where you can download a free white paper about some of the points discussed here. Or you can visit my website https://www.morrishealthcareconsulting.co.uk/contact-us/ or contact me at [email protected]

About Dr Keith Morris

About Dr Keith Morris

- 18 years in industry, supplying Pharmaceutical, Healthcare and Medical Industries:

- 12 years spent managing the product development of medical devices and laboratory filter products.

- Worked USA and supported customers throughout Europe.

- 4 years regional economic development focused on developing and growing a healthcare industry in North East England

- General Manager of start-up medical device company with a product to detect retinal damage associated with Glaucoma

- Commercial Director for NHS PCTs in North East England

- Seconded to NHS Technology Adoption Centre and latterly NE SHA to support accelerated adoption of new technologies into routine healthcare.

- Set up own business providing market access support to medical technology companies

- BSc in Chemistry with Biochemistry, Leicester University

- PhD in Biochemistry, University of Birmingham

- Professional training in Company Management (Institute of Directors)

- Professional Certificate in Marketing, Chartered Institute of Marketing