An interview with Dr. Rob Bunn, discussing the ways in which scientists typically choose consumables for their laboratory and how Agilent are trying to improve this through online selection tools.

What are the main ways people currently use to choose their consumables?

There are five different ways. The first one is the simplest: they just go with what they already know. It’s the tried and tested methods. They’ll buy from the same suppliers they’ve already bought from, and, if they want to tweak it slightly, then they’ll probably go to them first. It’s just using what they already have.

If there’s a new method that they’re working on, not something that they’ve done before, they may start with web or literature searches and look to see if they can find other people who have done similar applications, see what products they’re using, and use those as a recommendation. That’s quite labour-intensive.

They’ll also speak with colleagues or similar researchers within their network, again to find out if they’re running similar analyses and, if they are, how they’re doing it, who they’re buying their products from, who supports them, etc.

Usually at the last point they’ll request help from the manufacturers - that’s from their existing supplier.

Finally they’ll look outside of their existing supply base and try other suppliers. So it’s important that, when we have customers, we keep them.

What are the key issues in selecting the right consumables for your instrument?

It depends on, first of all, the instrument and the manufacturer of the instrument you’ve got. If you’re running a GC obviously you’re looking for GC supplies. If you’re running an LC you’re looking for LC supplies.

But it also sometimes comes down to who makes that instrument, because some of the parts on those instruments are generic and can be bought from multiple suppliers, and some of them are proprietary, so you can only buy them from those suppliers anyway. It’s not really a selection; it’s more the case that you have to buy them to ensure your instrument is functional.

For generic supplies, that’s where the competition is to make sure that the customer can select the most relevant product.

Another reason is their application. They want to make sure that they get the right product tailored to what they want to do. There are many products that would cover a whole broad spectrum of applications, so called universal products, but there are some which are very specific to particular applications. They’re tailored to give the best results on that application, not on a general application basis.

It also depends on the desired results of the customer. For example, if you had a university, they may only be interest in knowing if something is in the sample, whereas, if you’re looking at a drug testing laboratory, they need to know what’s in there and how much down to a very small amount.

So what results they’re trying to get will dictate where they’re going to buy their products from, because if they want really high-quality results they want a high-quality product that’s going to enable them to get that kind of sensitivity. If they just want a general yes or no/red or green light that it’s there then they could probably use a lower-quality product.

Another issue is the number of samples. A lot of times people talk about “how expensive is your product to buy? If I want a GC column, it’s more expensive than this competitor.”

But in reality if that column lasts three- or four-times longer and gives better results, the cost per individual sample is lower. The cost per sample is important to customers running a lot of samples, such as larger organizations or contract laboratories. They don’t tend to look at the individual costs of the products, they look at how long it lasts and how many samples they can run per column.

The delivery expectation of consumables is next day, so they want a supplier that has the product in-stock so that they don’t have to wait weeks. If they’re a contract laboratory where they’re running samples and getting paid for them, they can’t have the instrument not running samples. When they need a product, the delivery is very important.

Finally the support that they get is important e.g. when they have issues or they have a new application. Is the company able to provide them with the technical support to enable them to overcome those issues and keep the instrument running?

How does your application affect which consumables you should use?

Certain regulations dictate which types of products you have to use, not necessarily which manufacturer but which classification of product. If you’re in a regulated environment, you have to follow and use those products; you can’t deviate.

How many samples they’re running is also important. If they’re a high-throughput laboratory then that will change which products they use compared to other laboratories.

I mentioned in the previous question about desired results - if they want high levels of sensitivity or just general “yes/no it’s in there” results will also dictate what product they have.

Do they want the optimal performance? You can buy a product that will give you the result you want, but it won’t necessarily give you all the finer details. How far do you want to go?

The compatibility with the instruments is relevant as well. If you’re using somebody’s instrument, you may not be able to buy the product from somebody else.

Also specialty products are important. They may want something that’s made specifically for their application, for example, a pesticide column that analyses a specific pesticide. Can the manufacturer provide you with those as well?

Please can you outline the online selection tools Agilent has created to overcome the challenges of selecting the right products? What inspired you to create these solutions?

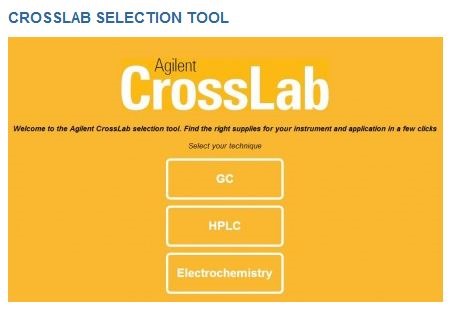

We have a series of online selection tools designed to be flexible based on what the customer wants and what they want to know.

The reason we wanted them was based on customer feedback. We get a lot of technical support questions that go to our technical support specialists asking, “I’ve got this product. What’s the Agilent equivalent?” or “I want to run this analysis. Which product should I use?”

We also have salespeople, and even though they’re trained, they may get a competitor’s product and want to know what the Agilent equivalent is to it. So it’s a customer and sales tool, and it was based on the number of questions we had asking, “Can you provide me which product is best for this?”

How were the online selection tools developed?

They were developed with the expertise we have. We have fifty years’ experience in chromatography, so we have a significant number of gurus around the world that are world-renowned in their field, and we use the expertise in-house to develop the tools based on their recommendations of products.

How do these selection tools differ to the solutions offered by Agilent’s competitors?

You’ll find that some (not all) of our competitors have interactive online tools. I think in most cases, though, they’ll be a cross-reference to a competitive product. So you’ll say, “I’ve got a Brand X’ LC column. What’s the Agilent equivalent?” and you’ll put the part number in and it will tell you.

All our tools do that; however, they also allow you to select by Agilent product, so, if you know a part number but you don’t know what the product is, you can put it in.

They also allow you to select by regulated method. For example, if you were running a semi-volatile analysis against EPA 8270, it would recommend the column that you should use for that method.

If you run a pharmaceutical method, you put in the method number, not the product, and it’ll tell you what column you should use.

A number of the tools also have a series of questions based on what the customer wants, so if you don’t know the competitive product, you don’t know the method, and you don’t know the Agilent product you want, it’ll ask you a series of questions that say, “Are you doing this? Would you like to do this?” You answer the questions, and at the end it’ll give you an output for a recommended product. That’s where the interactive bit comes.

How do you plan to keep these solutions up to date?

We have a regular review process, so we are enhancing the tools based on customer and the sales force feedback. They say that it’s great but it would be better if it did this, this, and this. So we work with the agencies that have developed the tools to improve them and add that functionality.

In terms of the updates of products, as we launch new products, they get added to the tools, and, as we identify that competitors have additional products, we add them to the tools as well. There’s a regular quarterly review that updates the tools.

On some of the tools there’s also the opportunity for the customer to say, “This part isn’t on that tool. Can you please help me?” When we make that suggestion to the customer for a product, we update the tools to include the recommendation.

What are Agilent’s plans for the future?

I think one of the biggest changes is moving away from paper materials. It’s not that we won’t make a paper catalogue, we will continue to do it because some customers still like having one; however, there is a big investment in making sure that we have electronic materials, because that’s the future.

We are making sure that our catalogues are not just PDFs, they’re web books. We have an interactive website where customers can order. I think the move to the digital age for product selection is the future.

Where can readers find more information?

For more information, please visit the Agilent website: http://www.agilent.com

About Rob Bunn

Dr. Rob Bunn is the EMEA Marketing Program Manager for Chromatography Consumables at Agilent Technologies, focused on promoting products & solutions that enable chromatographers to achieve their desired analysis results.

Dr. Rob Bunn is the EMEA Marketing Program Manager for Chromatography Consumables at Agilent Technologies, focused on promoting products & solutions that enable chromatographers to achieve their desired analysis results.

Prior to joining Agilent, Rob worked as GC Columns & Supplies Product Manager at Thermo Fisher Scientific. Rob holds a PhD in Analytical Chemistry from the University of Reading, UK. Rob lives in Cheshire, UK with his wife and two children.